Our Project: A Quantitative AI (QuantAI) Trading Ecosystem Built for Robustness & Monitoring

QuantAI trading infrastructure engineered to stay governable across regimes. Out-of-sample validation. Stress testing. Institutional monitoring for structured evaluation.

Business focus: proprietary AI trading strategies and internal research infrastructure. No retail services. No financial advisory. No third-party portfolio management. No software outsourcing.

Quantitative AI Ecosystem Overview

A multi-layered architecture designed for repeatability: from research to deployment, with auditable pipelines and monitoring-first thinking.

🏛️ The Technological Infrastructure

Our stack supports the full lifecycle: data ingestion, model training, backtesting, and controlled deployment with monitoring telemetry.

Research & Training Environment

Scalable compute for rapid experimentation and robust iteration, enabling repeatable validation cycles.

Decision Orchestration Layer

A central engine that aggregates model outputs, applies decision logic, and produces structured signals plus monitoring artifacts for review and audit.

Execution Layer (Internal)

An internal routing layer with reliability controls. Institutional previews—when offered—are observation-only and do not provide execution access.

R&D Sandbox

A controlled environment where new modeling ideas are stress-tested and validated before any production exposure.

🧠 The AI Specialist Team

A hierarchical team of proprietary AI components designed for diversity and disciplined filtering—reducing single-model bias and improving robustness.

Independent Advisory Teams

Multiple independent specialists analyze the market from different angles to strengthen ensemble diversity and signal resilience.

Master Decision Model

A pragmatic decision layer that evaluates independent recommendations and produces final outputs under reproducible rules and monitoring constraints.

Adaptive Risk Manager

A risk layer that assesses portfolio impact and enforces guardrails—prioritizing controlled exposure, drawdown awareness, and operational readiness.

We do not disclose training code, proprietary feature engineering, or model weights publicly.

Validation Discipline (OOS, Stress & Monitoring)

Markets are non-stationary. Our workflow prioritizes robustness over curve-fitting by combining out-of-sample evaluation, stress regimes, and monitoring signals designed to surface drift and anomalies.

Out-of-Sample Validation

We evaluate models on data not used during training to test generalization across time and regimes.

Stress Regimes

We test behavior under adverse conditions and simulated shocks to identify fragility and improve guardrails.

Production-Readiness Monitoring

Monitoring signals and dashboards help diagnose risk exposure, model behavior changes, and operational issues.

Validation (Selection) — 2024

Snapshot from internal research: model selection phase with KPI summary and equity curve.

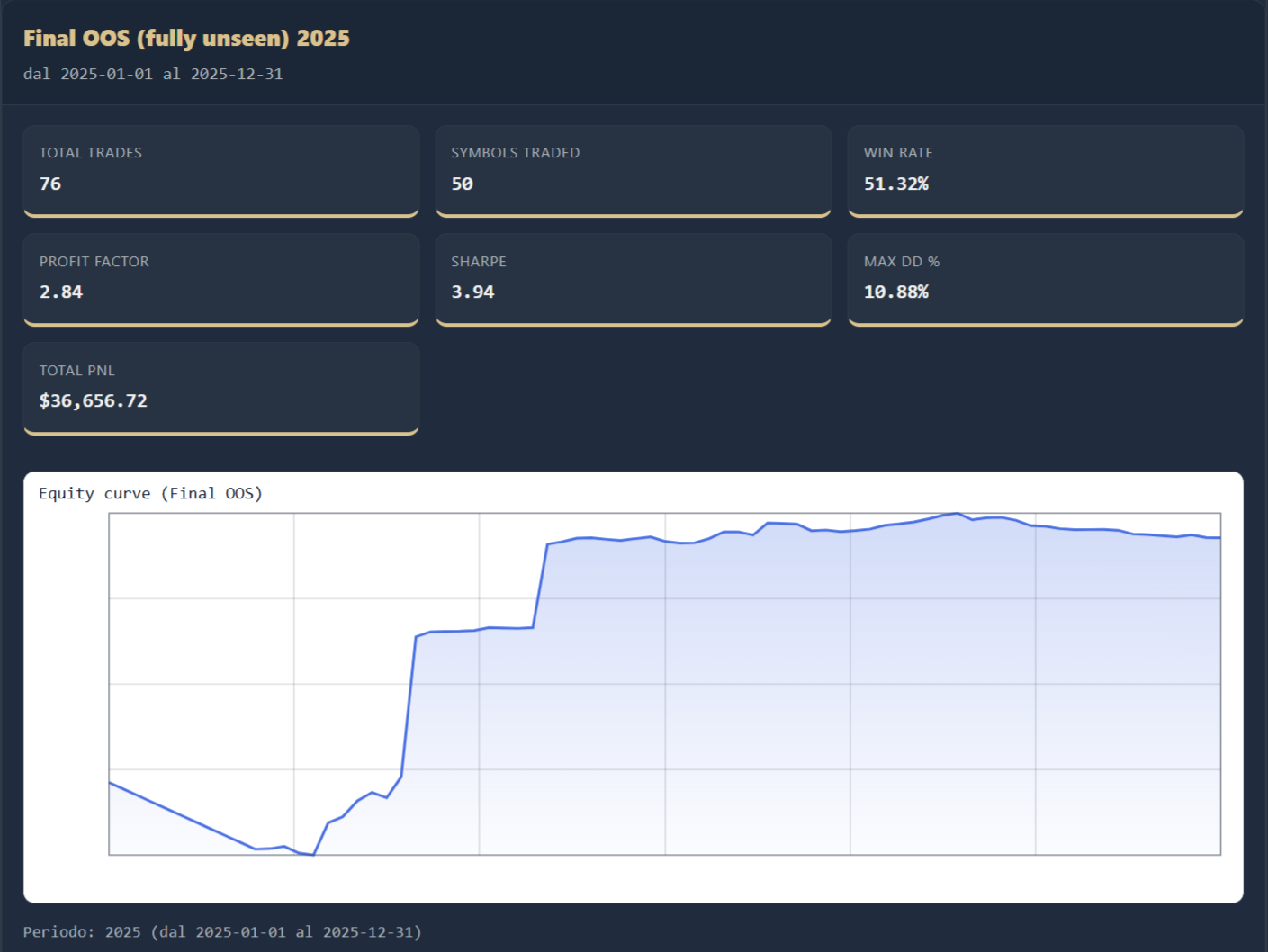

Final OOS (Fully Unseen) — 2025

Forward simulation on unseen data to evaluate generalization under consistent assumptions.

Stress Regime — 2020

Behavioral analysis during a historical high-volatility regime to evaluate risk containment.

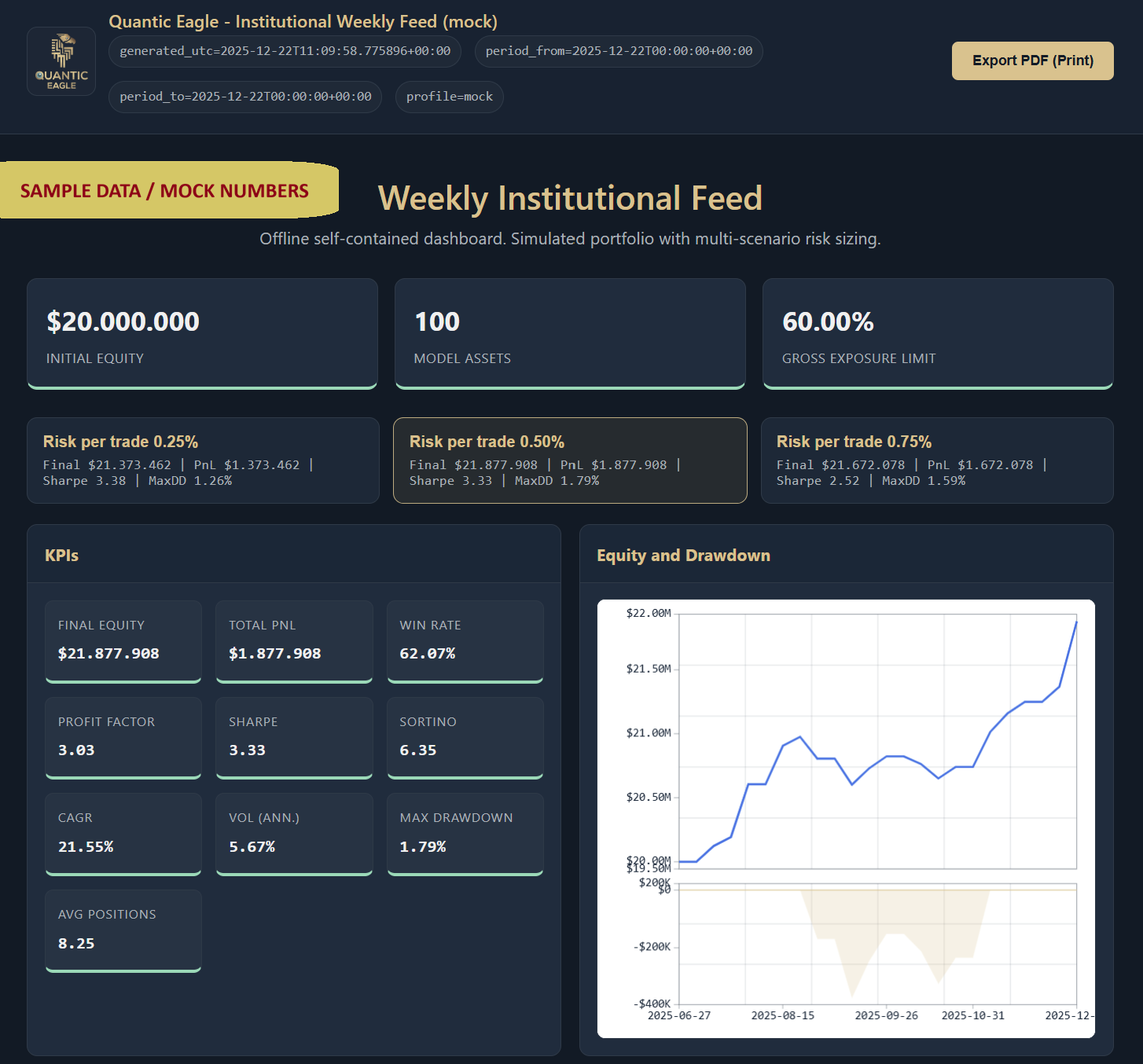

Institutional Monitoring Layer (Mock UI)

A preview of the monitoring dashboard designed for institutional evaluation. The UI is a mock and uses sample data to illustrate: positions, exposure limits, risk sizing scenarios, and equity/drawdown views.

* Sample data / mock numbers for interface demonstration purposes. Internal research snapshots are point-in-time and not indicative of future results.

Institutional Preview (Observation-Only)

After internal validation, we may offer time-limited observation-only access to a small group of institutional professionals and qualified profiles to gather feedback and explore collaboration pathways. Access is limited and not guaranteed.

What the preview can include

Monitoring views, signal snapshots, trade-level logs (entries/exits and timestamps), risk monitoring, and chart overlays to review model outputs and trade lifecycle.

What the preview does not include

No training code, no exportable model weights, no execution access, and no retail offering. This is for technology evaluation and research feedback only.

Who it’s for

Institutional professionals, strategic partners, and qualified profiles aligned with systematic research, monitoring, and risk discipline.

Important: This page is informational only. It is not an offer, not investment advice, and not a promise of future performance.

FAQ

Quick clarifications for institutional evaluation and research discussions.

Is this a public product launch?

No public launch date is announced. We share progress and may offer limited, observation-only previews for evaluation.

Do you provide execution access or account management?

No. Previews do not provide execution access. Quantic Eagle does not provide third-party portfolio management or retail services.

Are the screenshots live results?

No. They are internal research snapshots and/or mock UI with sample data. They are not indicative of future results.

Request Preview Access

For strategic collaboration and institutional evaluation, contact us through the confidential form below.