Quick clarifications for institutional evaluation and monitoring discussions.

What does “end-to-end

portfolio AI control system” mean?

It means a governed system covering the full portfolio decision lifecycle: signals,

allocation, risk controls,

execution decision-making (entry/management/exit), and monitoring. The focus is governance:

repeatable decisions

plus monitoring outputs that make behavior verifiable during evaluation.

- Portfolio-level decisions (not isolated single-asset calls)

- Position sizing and risk constraints designed to limit silent degradation

- Execution decision-making is internal; previews remain observation-only

- Monitoring-first outputs with structured review reports (audit-style evaluation)

What is an autonomous

hedge fund AI OS?

Think of it as a hedge-fund-grade operating layer that connects research discipline,

repeatable validation,

portfolio/risk controls, and monitoring telemetry under one governed system—built to scale

across asset universes while keeping oversight explicit.

Important: the preview is strictly observation-only. No execution access, no proprietary

training code,

no model export, no weights, and no integration.

How is this different

from a signal generator?

Signal generators often focus on directional calls. A portfolio control system focuses on

decisions under uncertainty:

how large positions are, what constraints apply, what risk budget is being used, how

positions are managed/exited,

and how behavior is monitored as conditions drift.

A simple illustration:

- A next-candle predictor might output “up” and trigger a trade with a fixed position

size.

- A portfolio control system asks: what outcome distribution is plausible, what is the

risk budget,

what exposures/correlations does this add, and what is the exit logic if conditions

change?

- That difference is where multi-day lifecycle decisions become governable: sizing,

constraints, and monitoring—not just entry direction.

What does

observation-only mean in the preview?

Observation-only means you can review monitoring and risk outputs for evaluation and

feedback, but you cannot execute,

integrate into your environment, export the model, or access proprietary code or model

weights. The goal is clean validation with clear boundaries.

What can I actually

see in the preview?

A limited, observation-only view of monitoring and risk dashboards, plus structured review

reports and signal snapshots—

enough to evaluate behavior in current market regimes.

- Observation-only monitoring and risk dashboard views

- Structured review reports and signal snapshots

- No execution access, no code, no weights, no integration

How do you protect IP

and confidentiality?

The preview is designed with clear IP boundaries: you evaluate behavior and monitoring

outputs without receiving proprietary internals.

No code, no weights, no model export, and no integration. Access may be time-limited when

offered (not guaranteed).

What do you mean by

regime shifts?

A regime shift is a structural change in market conditions—volatility, correlations, and

liquidity can change quickly—making behaviors

calibrated on a different period degrade. The system is designed to remain governable as

regimes change.

What do you mean by

silent degradation?

Silent degradation is gradual drift over time: exposures creep, correlations flip, liquidity

changes,

and a system can keep trading “as if nothing changed” until the problem becomes visible

(e.g., drawdown).

Monitoring is designed to surface it earlier.

How can it improve

fund governance and scaling?

It targets silent degradation with monitoring-first design, out-of-sample validation

discipline, and stress-regime behavior checks.

The intent is repeatability across asset universes and more audit-style, repeatable

review—scaling coverage without scaling headcount one-to-one.

- Monitoring-first design to surface behavior changes and risk concentration early

- Disciplined out-of-sample evaluation and stress-regime behavior checks

- Structured review reports to support repeatable evaluation and audit-style oversight

- Replicable across asset universes without replicating human monitoring effort

Do you provide

investment advice or manage third-party portfolios?

No. Quantic Eagle develops and implements proprietary AI trading strategies and internal

research infrastructure.

We do not provide retail services, financial advisory, or third-party portfolio management.

This page is informational only. Not an offer. Not investment advice.

Quick glossary (key

terms)

- Drawdown: peak-to-trough loss.

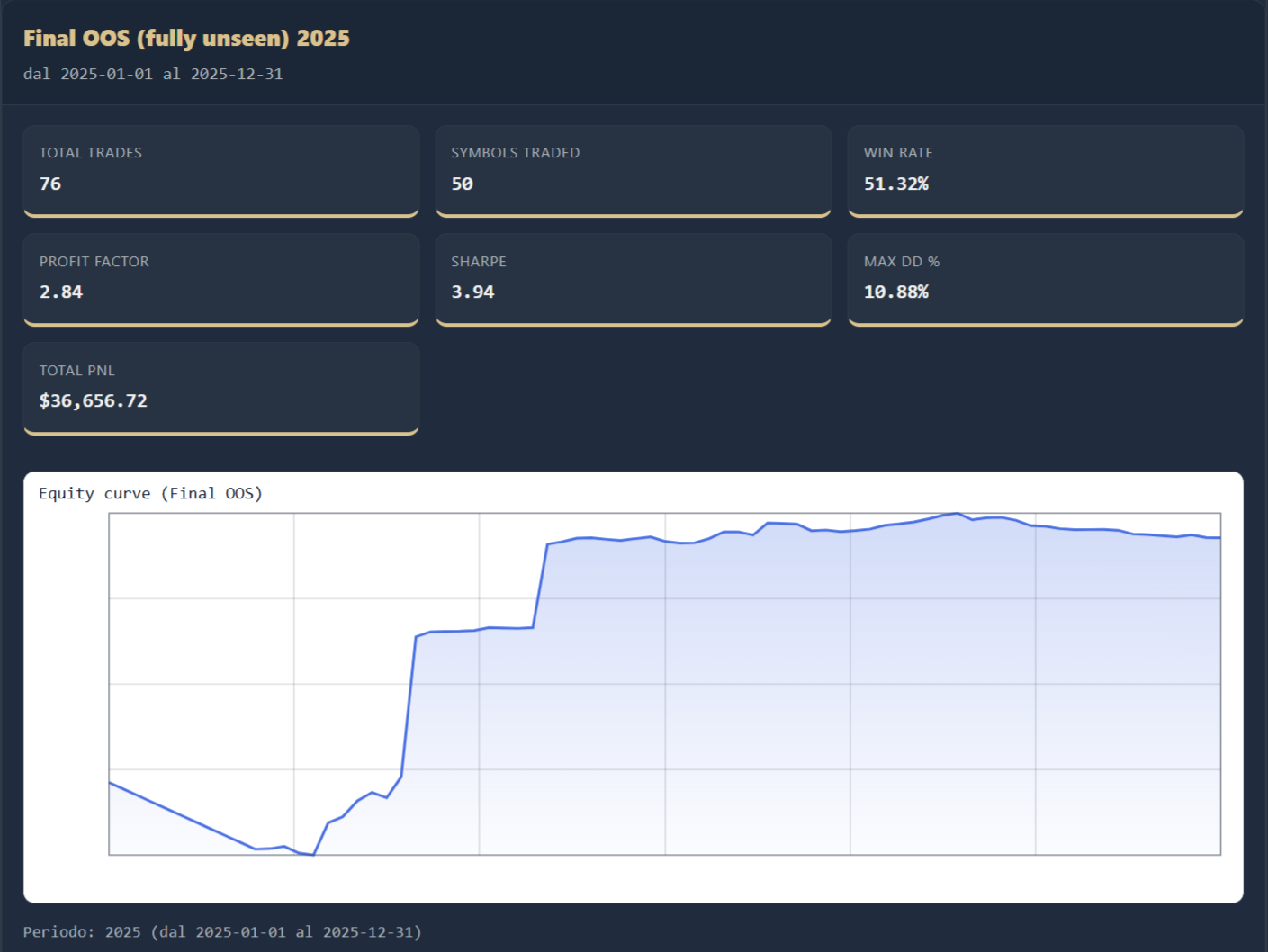

- OOS / holdout: a final period kept aside and never seen during

development.

- Execution decision-making: internal logic for entry/management/exit.

- Position sizing: how large positions are.

- Guardrails: risk constraints/limits.

- Correlation breaks: relationships between assets changing quickly.

- Drift: gradual behavior/risk change over time.